with any ERP/POS Seamless integration with any ERP/POS

a fraction of a second E-invoice generation in a fraction of a second

XML embedded PDF/A3 E-invoices with XML embedded

RELATED ARTICLES

- E-Invoicing in Saudi Arabia

- ZATCA e-Invoicing Phase 2: Applicability, Requirements, Rules and Regulations in Saudi Arabia

- ZATCA Announced Wave 2 Under Phase 2 of e-Invoicing in Saudi Arabia

- ZATCA Announced Wave 3 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 4 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 5 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 6 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 1 Under Phase 2 of e-Invoicing in Saudi Arabia

- How to Validate ZATCA e-Invoice Using QR Code?

- FAQs on Phase 2 of KSA e-Invoicing

- ZATCA Announced Wave 7 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 8 Under Phase 2 of Saudi Arabia e-Invoicing

- KSA VAT Number Verification: How to Verify a VAT Number in Saudi Arabia?

- Impact of ZATCA e-Invoicing on Saudi Arabia Businesses

- ZATCA Announced Wave 9 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 10 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 11 Under Phase 2 of Saudi Arabia e-Invoicing

- ZATCA Announced Wave 12 Under Phase 2 of Saudi Arabia e-Invoicing

How to Contact ZATCA Helpline?

Zakat, Tax and Customs Authority (ZATCA) is the apex body regulating tax-related matters in the Kingdom of Saudi Arabia (KSA). The taxpayers can contact this authority in case of any discrepancy in their tax matters to report any tax evasions or for various other matters.

How to Contact ZATCA?

The taxpayers can reach ZATCA through various mediums. These mediums may be:

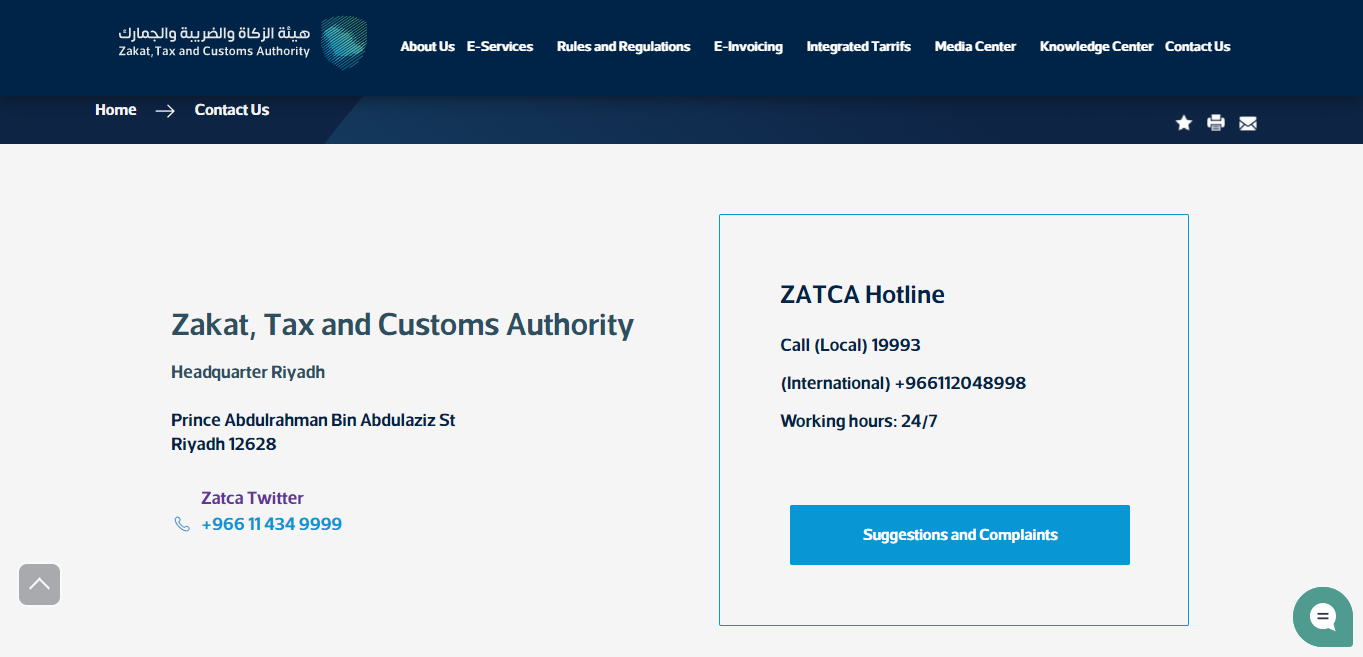

ZATCA Helpline Numbers

ZATCA has dedicated calling lines for its taxpayers. Local citizens can call at 19993. Taxpayers located outside KSA can call at +966112048998. These helplines are available 24*7 for taxpayer services.

ZATCA Mail ID

ZATCA dedicated a mail id under the customer service centre. You can send complaints and suggestions to the ZATCA mail id at info@zatca.gov.sa.

ZATCA Offices

The headquarter of ZATCA is located in Riyadh. Taxpayers can reach at- Prince Abdulrahman Bin Abdulaziz Street, Riyadh, 12628. Headquarter Contact details- +966114349999. Else, taxpayers may reach any local branch of ZATCA. The nearest branch can be located at https://zatca.gov.sa/en/contactus/Pages/default.aspx.

Twitter Handle

The ZATCA authority can also be reached at its Twitter handle https://twitter.com/Zatca_sa.

How to Report Tax Evasion in KSA?

The ZATCA strictly regulates the implementation of VAT rules and regulations and imposes stern penalties for any kind of evasion. If any taxpayer comes across any kind of tax evasion in KSA, they can report the same at this dedicated portal using the link below: https://zatca.gov.sa/ar/ContactUs/Pages/ReportFraud.aspx.

How to Share an Opinion on the ZATCA Portal?

The ZATCA invites taxpayers to share their opinions on how their services can be improved. The taxpayers can share their views at https://zatca.gov.sa/en/PortalServices/Survey/Pages/Surveys.aspx.

How to Give Feedback on the ZATCA Portal?

The taxpayers are also invited to submit their valuable suggestions, complaints, requests, and feedback on the ZATCA portal https://zatca.gov.sa/en/contactus/Pages/default.aspx#topic_complaint.

Let’s see them in detail:

Suggestions

The taxpayers can suggest the ZATCA portal on how services can be improved. They need to give details like their name, contact number, e-mail ID, TIN, subject of the suggestion and its details.

Complaint

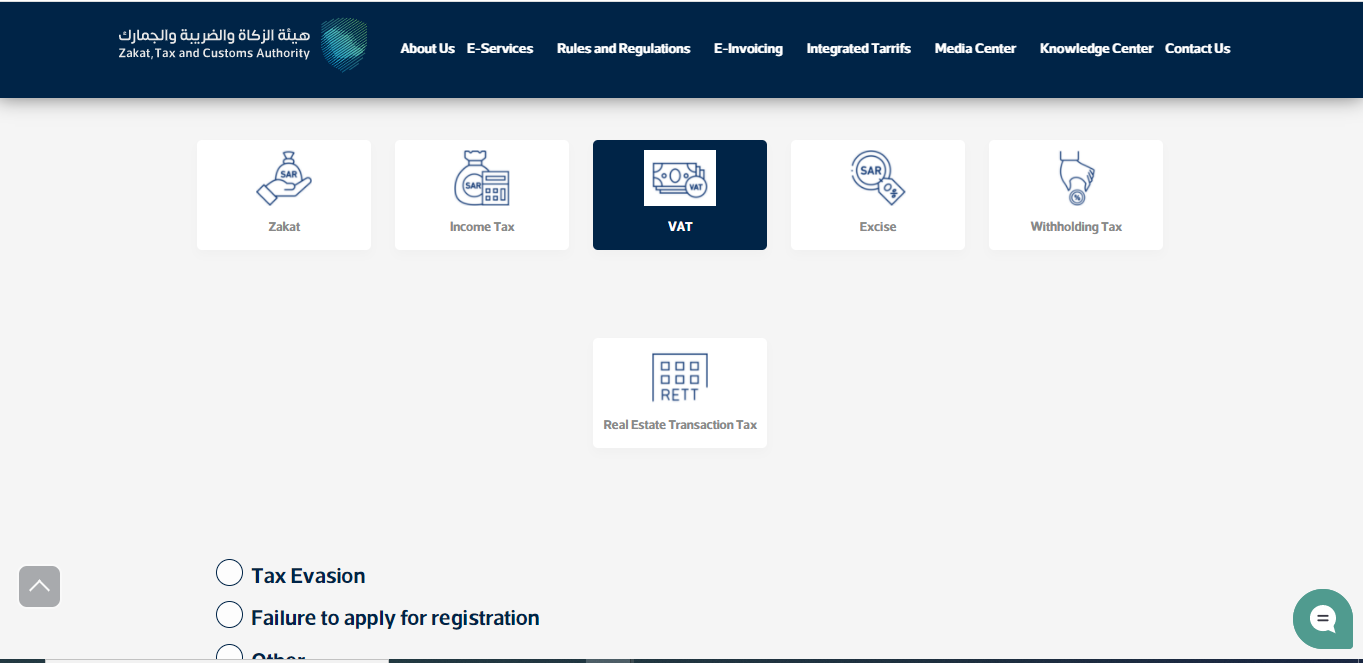

The taxpayers can also complain about the ZATCA portal. They need to submit details like name, contact details, TIN, ID number, CR number, company name, complaint subject, type, and details.

Request

The taxpayers can also make various requests related to Zakat, income tax, VAT, excise, withholding tax and real estate transaction tax through the same portal.

Inquiry

The taxpayers are also free to make inquiries with respect to any ongoing complaint or request to know their status.